A non-fungible token (NFT) is a unit of data stored on a digital ledger, called a blockchain, that certifies a digital asset to be unique and therefore not interchangeable. NFTs can be used to represent items such as photos, videos, audio, and other types of digital files. Access to any copy of the original file, however, is not restricted to the buyer of the NFT. While copies of these digital items are available for anyone to obtain, NFTs are tracked on blockchains to provide the owner with a proof of ownership that is separate from copyright.

In 2021, there has been increased interest in using NFTs. Blockchains like Ethereum, Flow, and Tezos have their own standards when it comes to supporting NFTs, but each works to ensure that the digital item represented is authentically one-of-a-kind. NFTs are now being used to commodify digital assets in art, music, sports, and other popular entertainment. Most NFTs are part of the Ethereum blockchain; however, other blockchains can implement their own versions of NFTs. The NFT market value tripled in 2020, reaching more than $250 million.

Contents

What are fungible and non fungible ?

Fungibility is the property of a currency in which every unit is exactly equal. It must have exactly the same value as any other. Every currency is fungible, for instance, every euro is exactly the same.

NFTs are not fungible, they are not equal. Every NFT is unique.

What is a nft ?

A non-fungible token (NFT) is a unit of data stored on a blockchain (a digital ledger) which can represent a unique digital item like art. An NFT is a cryptographic token, but unlike cryptocurrencies such as bitcoin and many network or utility tokens, NFTs are not mutually interchangeable, i.e., not fungible. An NFT is created by uploading a file, such as an artwork, to an NFT auction market, such as KnownOrigin, Rarible, or OpenSea. This creates a copy of the file recorded on the digital ledger as an NFT, which can be bought with cryptocurrency and resold. Although an artist can sell an NFT representing a work, the artist can still retain the copyright to the work and create more NFTs of the same work. The buyer of the NFT does not gain exclusive access to the work, nor does the buyer gain possession of the “original” digital file. A person who uploads a certain work as an NFT does not have to prove that they are the original artist, and there have been numerous cases where art was used for NFTs without the creator’s permission.

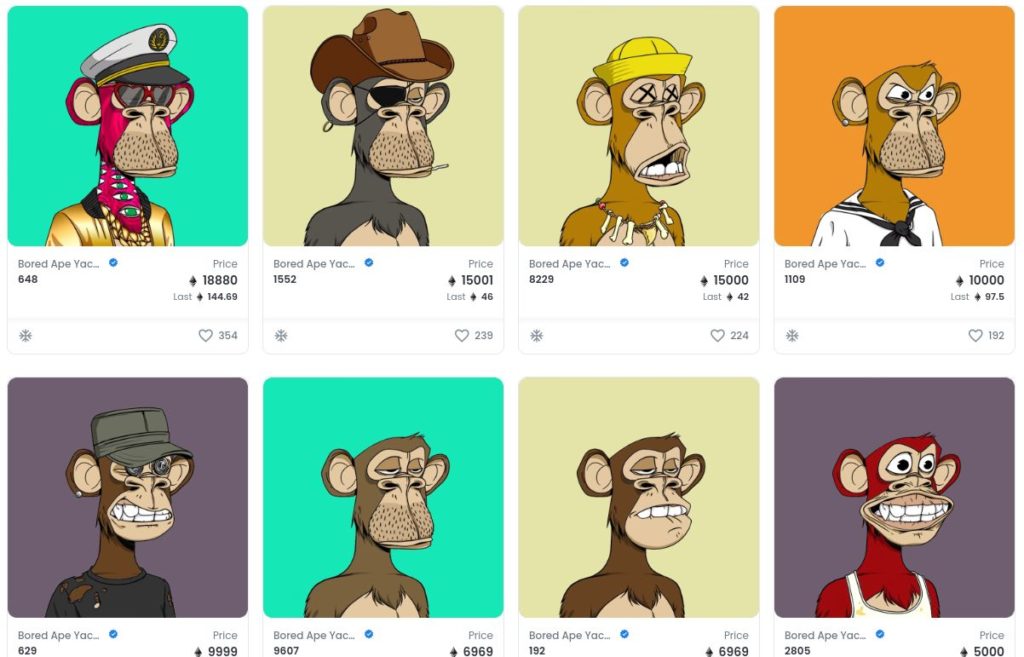

NFTs can represente the ownership of digital goods, like CryptoPunks or Bored Ape Yacht Club. NFTs are digital assets that can represent the ownership of real objects like art, or in the virtual world like objects and goods in videogames or on the Metaverse. NFTs are now growing fast and they have a lot of potentials application.

Adventage of NFTs

- NFTs are safe because transactions are private and controlled by smart contracts on the blockchain

- NFT can serve as a proof of ownership

- NFTs are limited because supply is limited.

- NFTs are transferable because ownership can be transferred.

Applications of NFTs

Non-fungible tokens are used to create verifiable digital scarcity, as well as digital ownership, and the possibility of asset interoperability across multiple platforms. NFTs are used in several specific applications that require unique digital items like crypto art (rare art), crypto-collectibles and crypto-gaming.

The first use case of gaming-related NFTs have been crypto-collectible trading card games. Projects like Age of Chains and Rare Pepes have been using the Counterparty protocol to issue Bitcoin-based blockchain trading cards as NFTs as early as 2016.

Art was an early use case for blockchain. NFTs prove the authenticity and ownership of digital art. The launch of CryptoPunks In June 2017 paved the way for “rare” art on the Ethereum Blockchain. DADA.art built from the CryptoPunks model and launched the first marketplace for rare digital art in Oct 2017

Later, popular blockchain games like CryptoKitties or BitAIrt made use of non-fungible tokens on the Ethereum blockchain. NFTs are used to represent in-game assets, and are controlled by the user, instead of the game developer. This lets the assets be traded on third-party marketplaces without permission from the game developer. Marketplaces for rare art include Nifty Gateway, Super Rare, Known Origin and MakersPlace.

Specific token standards have been created to support the use of blockchain in gaming. These include the ERC-721 standard of CryptoKitties, and the more recent ERC-1155 standard.

Digital art

Digital art was an early use case for NFTs, because of the ability of blockchain technology to assure the unique signature and ownership of NFTs. Digital artwork by Beeple sold for US$69.3 million in 2021. Christie’s made news in the auction industry by selling Beeple’s Everydays: The First 5000 Days for that sum.

Collectibles

NFTs can represent collectibles like card collections but in a digital format. In February 2021, a Lebron James slam dunk NFT card on the NBA Top Shot platform sold for $208,000.

Games

NFTs can also be used to represent in-game assets which are controlled by the user instead of the game developer. NFTs allow assets to be traded on third-party marketplaces without permission from the game developer. In February 2021, Axie Infinity recorded a sale of $1.5 million for digital land titles in a single sale.

Music

Musicians can tokenize their work on blockchains using non-fungible tokens. For example in March 2021, American rapper Lil Pump did a partnership with the NFT platform Sweet to release a special NFT collection.

Sports

Athletes are starting to take advantage of the NFT boom by tokenizing themselves or their body parts on NFT supporting blockchains. In March 2021, pro tennis player Oleksandra Oliynykova offered prospective NFT buyers the lifetime rights to part of her right arm.

Growth and mainstream appeal

Non-fungible tokens made their way into mainstream news when CryptoKitties went viral and subsequently raised a $12.5 million investment. RareBits, a Non-Fungible Token marketplace and exchange, raised a $6 million investment. Gamedex, a collectible cards game platform made possible by NFTs, raised a $800,000 seed round. Decentraland, a blockchain-based virtual world, raised $26 million in an initial coin offering, and had a $20 million internal economy as of September 2018. The video game 22 Series Racing raised over $100k in their NFT sale. Nike holds a patent for its blockchain-based NFT-sneakers called ‘CryptoKicks’.