When you want to trade bitcoin, there are simple and secure exchanges to buy bitcoins and other cryptocurrencies and have possession of the underlying asset. There are effective alternatives to using traditional exchanges to aim for better performance. Instead, you can trade Bitcoin through derivatives like CFDs. With these financial derivatives, You can speculate on the market price of bitcoin going up or down, and make profits even when the market is bearish.

Contents

Best Broker for Bitcoin Trading

| Trading type | Bitcoin Trading |

|

| Demo | Free Demo available | ||

| Deposit | 200$ | ||

| Regulated | yes | ||

eToro is one of the best bitcoin trading platforms and is regulated by FCA and Cysec, which are two of the most reputable financial market regulators in Europe.

You may also be interested in our review about Bitcoin Trader.

Bitcoin has started the trends on most of the cryptocurrencies on the market. It is a must-have cryptocurrency that many people know about, but few really understand. Bitcoin is known to be a very volatile asset. Bitcoin can experience massive price swings, which contributes to both high potential gains as well as greater risk of loss.

What is Bitcoin trading?

Bitcoin trading is the act of speculating on the movements of the price of the crypto-currency. Trading bitcoin has traditionally involved buying Bitcoin for euros or dollars on an exchange and trading them with the expectation that its price will rise over time. In order to make the most of bitcoin’s volatility, cryptocurrency traders are now increasingly using derivatives like CFDs or futures, which allows them to speculate on the rise and fall of Bitcoin prices and other crypto-currencies.

With eToro, you can now take positions and speculate on the price of bitcoin and other cryptocurrencies with financial derivatives like CFDs or just have possession of the underlying asset. Cryptocurrency CFDs are leveraged financial derivatives that allow you to take advantage of bullish price movements or bearish trends without taking ownership of the underlying assets of these derivatives, which means that you will not need to take responsibility for the security of the Bitcoin you trade.

What is bitcoin?

Bitcoin is the first and is the most popular cryptocurrency, It is a new form of virtual currency that allows everyone to eliminate the needs of traditional intermediaries in finance like banks and governments to carry out financial transactions. In other words, it is a peer to peer (p2p) means of payment.

Bitcoin was invented by Satoshi Nakamoto and emerged after the 2008 financial crisis. To enable people to use alternatives to banking and traditional payment methods. Bitcoin has become the most widely used digital currency among thousands of so-called cryptocurrencies.

Bitcoin is based on an innovative technology called blockchain, which is a kind of decentralized ledger in which transactions are noted, confirmed and encrypted.

The Bitcoin network is secured by miners who use special computers to verify transactions. For each new transaction validated and verified, the miner receives Bitcoins as a reward. The mathematical system controlling the generation of new bitcoins has been designed in a deflationary manner and is programmed to mine a maximum of 21 million coins.

Cryptocurrency is a form of digital currency. This means that there is nothing physical – everything is virtual and online. You can transfer cryptocurrency to someone without a traditional middleman like banks. Bitcoin and Ethereum are among the most widely used and popular crypto-currencies, but new cryptocurrencies continue to emerge.

Some might buy cryptocurrencies as a regular investment just like real estate or stocks, hoping that the value of cryptocurrencies will increase over time. It is getting easier and faster to buy it. You can buy the cryptocurrency with a credit card at most specialty brokers, or in some cases, get it through mining.

Best Regulated Broker for Bitcoin Trading

| Trading type | Bitcoin Trading | |

| Demo | Free Demo available | ||

| Deposit | 200$ | ||

| Regulated | yes | ||

What do you need to know when trading Bitcoin?

There are some key factors you should always take into consideration to be sure that you are trading bitcoin.

The value of bitcoin is volatile and is based entirely on supply and demand.

Bitcoin price fluctuations are therefore considerable and can positively or negatively affect your earnings in bitcoin trading.

Bitcoin trading is a discipline that involves strict risk management and various strategies to maximize your chances of success. There are various emotional factors that could affect your decisions and cause you great loss. Along with mismanaging your portfolio, the fear of missing out on a earning opportunity (FOMO) and panic selling are the most common mistakes beginner traders make.

Since bitcoin is an extremely volatile asset, it is common to see price spikes. It can cause you to fear missing out on a major profit if you don’t buy quickly. This type of behavior is downright absurd and goes against the most important rule in trading – buy low, sell high.

If you see bitcoin skyrocketing in a very short period of time, there is a good chance that you have already missed your entry points and the price will retrace. and you will end up buying an expensive asset that is likely to fall in value.

Likewise, you need to be able to hold your position and not panic with every wave of a market correction. Drops and retreats from -5 to over -35 percent are common in the cryptocurrency market and should not scare you if you manage your risk and your portfolio well. Falling victim to FOMO, or panic selling are the main reasons most newbie traders fail.

But why is this digital asset so volatile? So here are some of the many factors behind the high volatility of bitcoin.

Negative events and news affect the price of cryptocurrencies and can scare off Bitcoin investors and traders. These events can be geopolitical such as government statements or news articles that can cause uncertainty and investor fear regarding cryptocurrencies.

Negative news is usually one of the main factors that causes the value of bitcoins to decline rapidly against fiat currencies. The positive news, on the contrary, reassures investors and often causes the price of bitcoin to rise against traditional currencies such as the dollar or the euro.

One of the main reasons that bitcoin attracts new investors and fluctuates against fiat currencies is the perceived store of value. Bitcoin is deflationary unlike conventional currencies and is limited to a fixed amount of 21 million BTC. This technology also has the particularity of allowing an almost instantaneous transfer of value. Just like with fiat currencies, the value of bitcoin fluctuates depending on current events and the trust that its users have.

However, more large companies and investors are taking an interest in it and becoming favorable to bitcoin, which contributes to its rise in value against the dollar and euro over time. For these reasons, it is therefore likely that the value of bitcoin will also gradually increase over the next few years.

Why is Bitcoin Trading so popular?

Bitcoin trading is very popular these days, especially for its potentially higher returns compared to the traditional financial market due to its high volatility.

Bitcoin and cryptocurrency are relatively new assets, which are experiencing significant volatility due to short and long term speculative interests. These are assets that could revolutionize the future of the modern economy and are therefore often likely to attract strong speculative interest.

It is this unique cryptocurrency volatility that attracts traders from around the world and is part of what makes this market so attractive to traders. Rapid price fluctuations offer many opportunities for traders to aim for greater returns, but this market also carries more risk than more traditional markets like the stock market. So, before entering the fascinating world of Bitcoin trading and Cryptocurrency trading, it is important to do your own research to understand this market and develop your risk management strategy.

How to trade Bitcoin?

Now we are going to get down to business. After reading our guide to Bitcoin trading, you know that cryptocurrencies are extremely popular high yielding assets these days, with high volatility featuring massive rises and bearish periods which may scare some investors. . Fortunately, to trade bitcoin on the eToro platform, it is not necessary to have technical knowledge of blockchain technology to start trading Bitcoin and cryptocurrencies.

To start bitcoin trading:

- Open an eToro account

- In your account, select bitcoin or the crypto you want to buy

- Click on the “Trade” button

- Indicate the amount of your desired investment

- Then click on the “Open Trade” button

On eToro, after registering, you have access to a demo account with a virtual cash capital of $ 100,000 to train without any conditions, allowing you to practice bitcoin trading and experience the platform without risking your money. You can open a free demo account here and start trading without the associated risks.

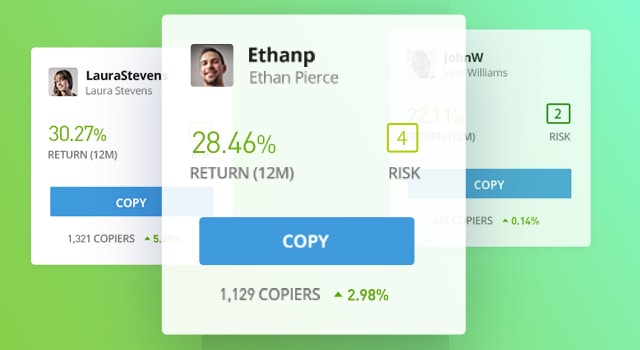

Can I trade Bitcoin by copying other traders?

Yes. Etoro is one of the rare trading platforms that allow you to trade bitcoin by copying from other traders. The copy trading function available on eToro allows you to allocate part of your capital to copy other traders.

Thanks to the copy trading technology available on the eToro platform, each time the trader you want to copy executes a buy or sell position, the same trade is automatically opened in your trading portfolio. And this, in proportion to the amount with which you allocated to copy the trader. When it comes to copy trading with cryptocurrencies, many traders who trade with this broker specialize in trading cryptocurrencies, which allows you to copy them automatically with just a few clicks.

| Trading type | Bitcoin Trading | |

| Demo | Free Demo available | ||

| Deposit | 200$ | ||

| Regulated | yes | ||