Crypto trading has become more and more popular in recent years. Notably thanks to the high yield offered by this type of market and the possibility of generating high profits over a short period of time. If you are interested in cryptocurrency trading, it is important to know what it is, how it works, which are the best platforms for crypto trading and how to start. Here is a guide to explain the ins and outs of crypto trading:

Contents

Best crypto trading app

| Trading type | Crypto Trading | |

| Demo | Free Demo available | ||

| Deposit | 200$ | ||

| Regulated | yes | ||

What is cryptocurrencies?

Cryptocurrencies are a relatively new form of currency that was created via the use of cryptography. Cryptography is a science that was developed in the mid-20th century. It uses complex algorithms and codes to secure sensitive data, such as, money. The basic concept of cryptocurrencies is that all transactions are recorded on a massive decentralized public ledger, known as blockchain.

Anyone can use this ledger to do many transactions. However, a cryptocurrency can only be spent when the correct code or decryption key is used to unlock the digital signatures. Cryptocurrency’s are based on blockchain technology, which uses decentralized ledgers to record transactions between two parties. Blockchain technology uses a peer-to-peer network, which means no central authority or bank is needed to verify transactions. This form of technology was first created for the virtual currency Bitcoin. But now, hundreds of other cryptocurrencies, or altcoins, have been created. Cryptocurrencies are typically created as a reward for mining. This process involves computers solving complex math problems, which release new units of currency.

Bitcoin is the first decentralized cryptocurrency. It was created by a pseudonymous developer (or developers) named Satoshi Nakamoto. Nakamoto published a paper referred to as “Bitcoin: A Peer-to-Peer Electronic Cash System,” under the pseudonym Satoshi Nakamoto. This paper describes Bitcoin’s technical details. It also explains the concept for a decentralized electronic cash system. Nakamoto envisioned a decentralized network known as a blockchain. The blockchain acts as an immutable public ledger that records all transactions.

The blockchain uses cryptography to secure its transactions. Like many others crypto, Bitcoin utilizes a peer-to-peer system. It permits individuals and companies to execute transactions without the need of a federal government, clearinghouse or intermediary. Instead, buyers and sellers interact directly with each other.

Ethereum is a cryptocurrency platform. It permits developers to build decentralized apps. It utilizes a blockchain network to supply security. Ethereum utilizes smart contracts, which permit folks to set particular conditions for particular occasions. For instance, you can set a smart contract to auction off an item to a specific customer once a particular number of coins are traded. The smart contract would run that program and carry out the exchange once the terms are met.

Satoshi Nakamoto released Bitcoin in 2009. He understood a digital currency was the future. So he developed the bitcoin cryptocurrency. The goal of bitcoin is to allow individuals to trade value simply, securely, and anonymously. Bitcoin utilizes an open-source ledger system to record transactions. These transactions are then added to a block, which is connected in a chain. Then, these blocks are linked with each other and are a part of a public ledger, known as blockchain. Your Bitcoin address is provided when setting up a bitcoin wallet. The wallet permits you to send out and receive bitcoins. Each bitcoin address is a series of numbers and letters. These addresses are like e-mail addresses. Bitcoin utilizes public addresses, which permit you to receive bitcoins. These public addresses are like e-mail addresses. Private addresses, on the other hand, are utilized for spending your bitcoins and to keep your bitcoins safe.

What is crypto trading?

Crypto trading is all about making profits from the difference in the price of buying and selling cryptocurrencies. Crypto trading is based on buying and reselling crypto on an exchange platform in the hope that its price will rise or fall over time. Crypto traders also use derivatives like CFDs or Futures to speculate on the rise and fall of cryptocurrency prices.

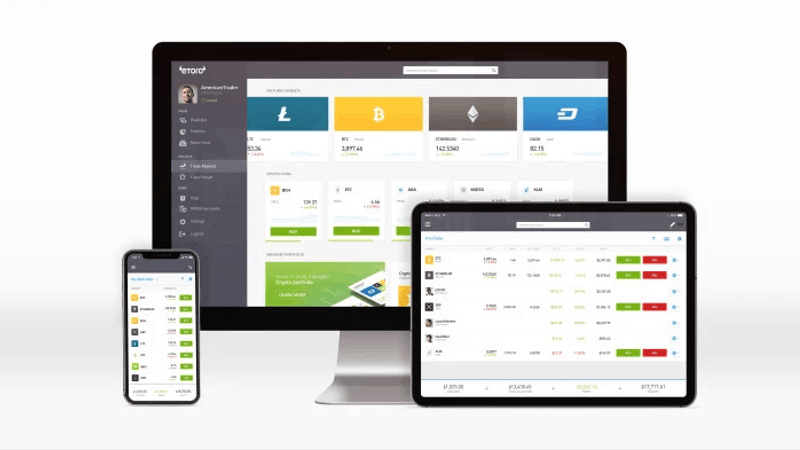

With eToro, one of the most reputable European cryptocurrency trading plateform, you can speculate on the price of different crypto-currencies with financial derivatives like CFDs or take possession of the underlying asset such as on the more traditional crypto trading platforms. CFDs also called contract for difference are leveraged financial derivatives particularly popular with daytraders and trader looking to make short term profits in this lucrative market. These financial derivatives allow you to be exposed to the cryptocurrency market and to profit from bullish or bearish price movements in cryptocurrencies without taking possession of the underlying assets. Thanks to the trading of crypto CFDs, you will not need to assume the security of the cryptocurrencies you are trading as they are in the form of a financial contract.

Crypto trading comes in two forms: exchange of CFD (Contract for Difference) and the buying and selling of cryptocurrencies.

The cryptocurrency market is evolving and growing. There are no less than 8,000 cryptocurrencies in this market with which you can trade to make profits.

Among the 8000 cryptocurrencies on the market, not all are equal, some projects are serious and very promising while others are very risky and have a high probability of being a scam. Bitcoin is the leading cryptocurrency with more than two-thirds of the total cryptocurrency market capitalization. What you need to trade bitcoin and cryptocurrencies is a serious and secure trading platform. In the following, we will explain to you which criteria are important to consider and which trading platforms you can use to trade crypto-currencies and how to start trading crypto in good conditions.

Best Broker for Crypto Trading

| Trading type | Crypto Trading | |

| Demo | Free Demo available | ||

| Deposit | 200$ | ||

| Regulated | yes | ||

Click on the link below to see our article about Bitcoin Trading.

What moves prices in the cryptocurrency markets?

The price of crypto-currencies is not fixed and evolves according to supply and demand. However, these are decentralized assets, and decorrelated from many economic and political factors that impact the price of traditional currencies. Although it is a very speculative market, with a lot of uncertainty, certain factors can also influence the rise or fall of their prices:

Supply: The overall quantity of coins and the rate at which they are put into circulation, destroyed or lost.

Market capitalization: This represents the value of an existing cryptocurrency and gives an overview of this evolution.

Press: The media can influence the price of cryptocurrencies, positive news about a cryptocurrency generally influences its price to rise, while negative news scares the investor and tends to lower its price.

Adoption / Integration: The adoption or integration of a cryptocurrency into existing infrastructure such as e-commerce payment systems can impact the price of cryptocurrencies, creating more demand and thus driving up the price of digital assets.

Key Events: Various events such as updates and regulations, security breaches and economic setbacks also have a great influence on cryptocurrency prices.

To be able to trade crypto you need a specialized platform that will allow you to enter this market. However, with the increase in the number of crypto trading platforms it becomes difficult to choose a serious trading platform. We have therefore made this article to guide you and explain in more detail the selection criteria when choosing a trading platform.

How to chose the best crypto trading platform?

What are the criteria for selecting a serious cryptocurrency trading platform for beginners? The following points are the deciding points for choosing the best crypto trading platform:

Free Demo Account: This is an important point that allows you to test your trading platform and strategies without the risks associated with crypto trading. Whether you are a beginner trader or expert trader, this option is always useful to discover the platform and its features before depositing money.

Fees and payment methods: All platforms charge fees for trading in the form of percentage or spreads. You should also check what are the payment methods for deposits and withdrawals and if they suit your expectations, it can be cryptocurrency or with a multitude of popular payment methods such as PayPal, Skrill or by credit card.

Minimum deposit: cryptocurrency trading is not reserved for a wealthy elite, small investors are also welcome and can trade cryptocurrencies on a low budget. However, most exchanges set a minimum amount to deposit in order to start trading.

Available Cryptocurrencies: Some cryptocurrencies like Bitcoins are very popular and can therefore be traded on most crypto trading platforms, but not all exchanges offer all of the available cryptocurrencies. It is therefore important to check the available assets and choose a platform that allows you to trade the crypto-currencies that you are interested in.

Security: The security of the platform is also a very important criterion when choosing your crypto trading platform. Cryptocurrencies attract cybercriminals and hackers. It is therefore wise to check if your trading platform is equipped with SSL encryption and two-factor authentication (2FA) which are the basics and will in most cases guarantee the security of your funds.

Regulation: The main idea of cryptocurrencies is that they are assets outside the banking system and government control and regulation. This is why a lot of cryptocurrency exchanges are not regulated. However, it can cause you problems or the loss of your funds in case of irregularities or negligence by these platforms. eToro is one of the only trading platforms regulated by several financial regulators within the EU, guaranteeing the security and reimbursement of your funds in the event of disputes. This is why eToro is a particularly recommended crypto trading platform for beginners. With all other platforms, you can’t have the same guarantees that regulation gives you if something goes wrong.

Best Regulated Broker for Crypto Trading

| Trading type | Crypto Trading | |

| Demo | Free Demo available | ||

| Deposit | 200$ | ||

| Regulated | yes | ||

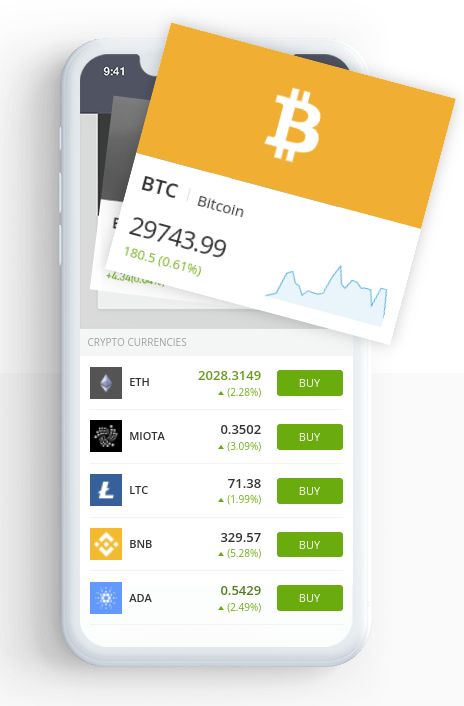

Choosing a crypto trading application

Traders who want to trade anywhere should consider using a crypto trading app. Many traders use trading apps to stay on top of market developments and react quickly to market changes while on the move.

Crypto trading platforms are free smartphone applications made available by the broker in addition to their web platform. eToro allows these users to use their trading app, you can download it from the Apple App Store and on Google Play.

If you want to trade cryptocurrencies as well as stocks and other securities through a simple and intuitive trading app, we recommend the eToro trading app because it is one of the more interesting options. eToro does not only offer CFDs, it also offers commission-free stock trading through its app and the purchase of cryptocurrencies.

How to trade crypto ?

Now that you know that cryptocurrencies are high yielding assets and very popular these days with extreme volatility. we have created a small tutorial for you to guide and help you trade crypto on the eToro platform.

To start crypto trading:

- Register on the official eToro website

- After opening your account, In your account, select the crypto you want to trade

- Click on the “Trade” button

- Then indicate the amount of your desired investment

- Then click on the “Open Trade” button

eToro offer access to a free demo account with a virtual cash capital of $ 100,000 that allows you to practice trading cryptocurrencies without any conditions, the demo account is a very useful option to fully understand how the platform works as well as to test various crypto trading strategies without risking your money. You can open a free eToro demo account to learn and practice crypto trading without the associated risks.

| Trading type | Crypto Trading | |

| Demo | Free Demo available | ||

| Deposit | 200$ | ||

| Regulated | yes | ||

Cryptocurrency glossary:

Cryptocurrency Wallets: Wallets are important to holding your cryptocurrencies. They hold the keys for you, so you don’t need to fret about losing. You can backup the wallet with a seed phrase.

Cryptocurrency Exchanges: Exchanges are where you trade cryptocurrencies for other coins, USD or other Cryptos.

Cryptocurrency Protocols: Protocols are the roadmap of a cryptocurrency. The protocol outlines exactly how a cryptocurrency works. You can use a lot of cryptocurrencies at either exchanges or wallets. However, some operate on their own protocol.

Cryptocurrency brokers: Crypto brokers are platforms where individuals can trade cryptocurrencies. These exchange platforms supply value for your altcoins, and permit you to trade them like on a cryptocurrency exchange but with CFD contracts.

Cryptocurrencies Marketplaces: Marketplaces are platforms where you can utilize cryptocurrencies to purchase items. These cryptocurrency exchange platforms offer value for your cryptocurrencies, so you can use them to purchase things, without having to exchange them for fiat currencies like Euros or Dollars.